By David A. Belforte

Since 1970 more than a half million industrial laser systems have been installed globally, so it is fair to say they are now firmly established in material processing operations among the world’s manufacturing industries. Recent statistical reports estimate that more than $80 billion of machine tools were sold globally in 2015, and in addition $8 billion of industrial laser systems that qualify as machine tools. Therefore logic suggests that, statistically, industrial laser sales should track machine tool sales.

However, not since the recession of 2008/09 has there been such uncertainty in the global manufacturing sector. In 2015, world economic conditions deteriorated as highly publicized events in China, Southeast Asia, Europe, South America and the mid-East led to reduced machine tool demand, except in the US, where manufacturing expected to increase machine tool purchases.

Confusing market conditions in China and Japan quenched growth in Asia, the world’s largest market for machine tools and lasers. Europe did stabilize after months of troubling economic news, i.e., problems at the world’s leading auto company, terrorist attacks and the impact of massive refugee migration, which shook Western Europe, quenching growth in the Eurozone economies. The predicted economic contributions from emerging nations did not materialize and the anticipated consumption power of the BRIC nations did not develop. As a consequence, global exports of capital goods declined in 2015.

In contrast to this negative economic news was the upbeat attitude in the industrial laser sector, led by positive financial news from the leading makers of these products. TRUMPF Laser Technology group turned in a 16.8 percent growth to € 890 million and IPG Photonics Corporation, the world’s leading fiber laser manufacturer, reported an outstanding 22 percent growth in the third quarter, and predicted seasonally adjusted fourth quarter sales growth that would take the company close to the $1 billion revenue level.

After tracking machine tool sales since the recession, was the 2015 laser industry revenue result out of sync with global manufacturing revenues? There is some support for this as only one industrial laser company reported strong double digit growth quarter to quarter — IPG Photonics. Overall performance of the major industrial laser companies was mixed; the largest companies that have shown growth over the past two years are primarily the suppliers of fiber, disk and ultra-fast pulse (UFP) lasers.

In 2015, the laser industry surpassed the machine tool curve, supported by strong sales in key market sectors, extending into first quarter of 2016. The substantive revenue growth of fiber and UFP laser suppliers is towing the total revenue numbers of the other underperforming companies along with it.

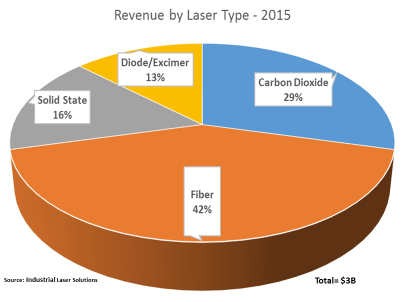

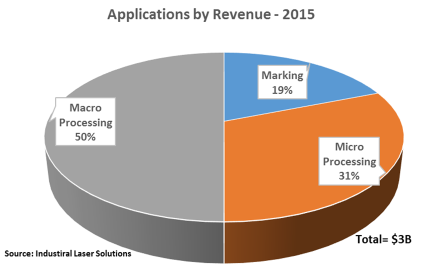

Total industrial laser revenues grew by mid-single digits in 2015, led by the continued strong double digit growth of fiber lasers, which represent more than 40 percent of total laser revenues, thereby dominating the industrial laser market. High-power fiber lasers for macro material processing that carry a high selling price per unit comprise about 45 percent of all industrial lasers sold for this application segment. Medium power fiber lasers also make up more than a third of microprocessing revenues and low power fiber lasers totaled are close to half of the laser marking/engraving segment.

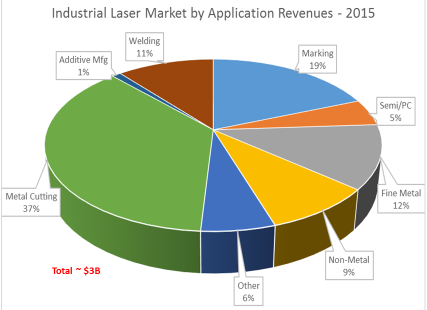

Macro material processing revenues also grew, boosted by a mid-single digit increase in welding installations and a double-digit increase in the largest segment — cutting. Fiber laser growth continued at a high level in the metal cutting sector increasing its share of the total market at the expense of CO2 and solid-state lasers. Fiber laser applications grew in all manufacturing segments with a single-digit increase in low-power for marking and medium power for micro materials processing, and a strong double-digit in macro applications.

CO2 lasers lost market share across the board from low to high power as a combination of medium to high power fiber and disk lasers eroded market share. Solid-state laser revenues were flat, as higher revenues in disk lasers offset declines in diode-pumped solid-state marking applications.

Modest single digit growth in marking and micro material processing, compared to the more robust single-digit for macro processing, may be the precursor to slowing growth in the 2016 laser market.

Additive manufacturing technology attracted global manufacturers, however sales of moderate to very large size processing systems that grew rapidly since 2014 are expected to slow somewhat in 2016 due to temporary overcapacity in the market.

The semiconductor/pc board/display market took a hit in 2015 and consequently industrial lasers followed, showing the largest decline of all the applications. This is for the most part cyclical, a recurring situation that industry has experienced before.

In the 2015 Micro Processing category, fine metal processing represented more than a third of revenues.

In the US, the economy slowed in the last quarter of 2015, dragged down by cuts in business investment and a widening trade deficit. And an observer remarked that 2016 will be, “… an almost boring year with slight gains or shortfalls in industry segments but nothing spectacular in either direction.” Which sums up most of the opinions on the Internet on a drop in durable goods orders, a key measure of US manufacturing, which last quarter experienced the largest annual decline since the end of the recession of 2008/09. Starting in 2016, the ISM reported that 55 percent of manufacturing companies surveyed reported contraction in new orders, production, employment and raw materials inventory in December. The suggestion is that US manufacturers prepare to ride the waves for at least the first half of 2016.

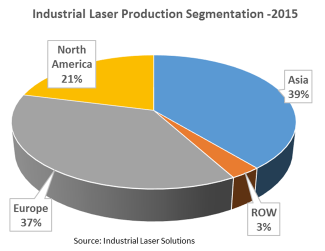

Which brings us back to the opening of this article and the laser industries seemingly contrarian economic condition to machine tool sales in 2015. Last year the global market segmentation for industrial lasers looked as shown.

Asia, dominated by China, generated about 39 percent of all industrial laser revenues. Reflecting a slowdown in exports to China, Europe dropped slightly to 37 percent and North America, the most stable economic region in 2015, held steady. South America, Africa, Australia and Israel are included in the ROW category.

The forecast in 2016 is for industrial laser revenue growth to drop slightly to 6 percent from the 7 percent growth in 2015, not due to any diminishment of manufacturing industries acceptance of industrial laser materials processing of their products. It is simply that like machine tools this technology will feel the effects of global economic slowdown, especially in the past years strong market in the US.

David Belforte is the Editor-in-Chief of Industrial Laser Solutions.